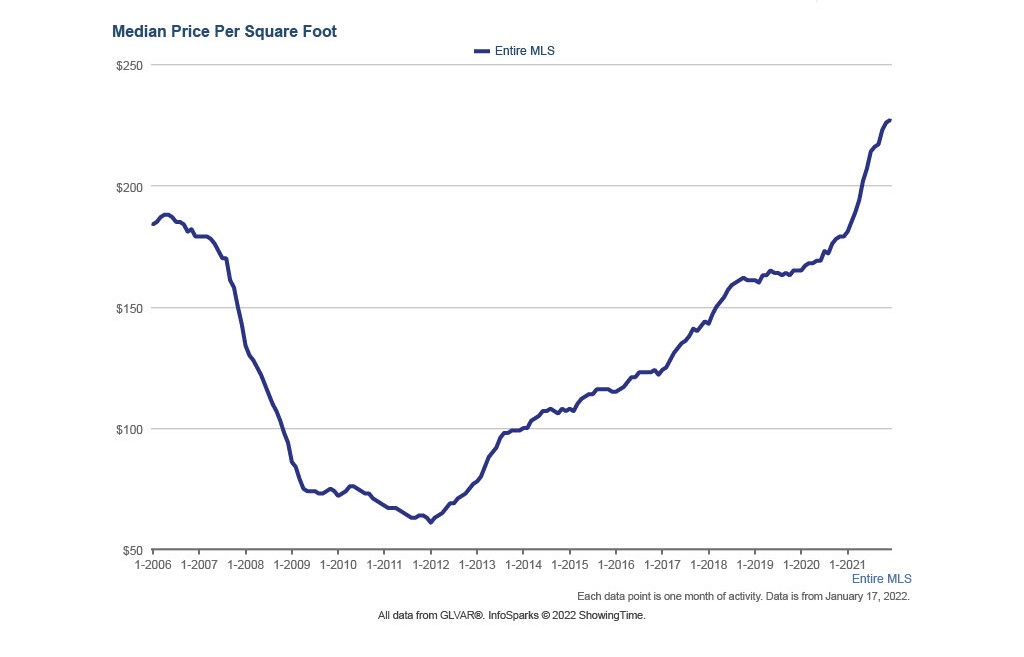

Since the 2011 housing crash, the Las Vegas housing market has been strong. Prices rose until October 2018, and from then until June 2020, we saw fairly stable prices even when demand dropped amid the lockdown (see pending sales chart two). Then starting in June 2020, prices jumped. This was a direct result of government policies of artificially low interest rates and massive government stimulus that kept the housing market trending up. Starting in June 2022, the Federal Reserve started increasing interest rates to fight rising prices. We can see that in June 2022 the uptrend was broken then started again in February 2023 as back door monetary easing was put in place for the banking sector. Check out the latest charts on mortgage interest rates.

Live Charts of the Las Vegas Housing Market

The charts below update monthly and give you the most up-to-date information regarding prices and pending home sales. As you can see, Las Vegas home prices are now well above the old 2006 highs. The easy money and low-interest rates of the Covid era have given way to the Federal Reserve raising interest rates to stop housing inflation.

Since interest rates increased, there has been a drop in housing prices which was a trend until Feb 2023 then a much slower rise in prices has been seen.

This next chart shows average monthly sale prices. The dramatic rise in prices after the housing crash started in January 2012 and stabilized at a slow, rising pace around April 2019. As of April 2020, a new jump began. Arguably, this jump was due to government stimulation and artificially low interest rates. The rising trend was broken starting in June 2022. March of 2024 will be interesting. Will the Federal Reserve continue to print to help the banking system and government deficit spending or will they allow interest rates to rise to defend against rising prices?

This chart shows Pending Home Sales. Pending sales usually drop during winter months and have significant gains heading into spring. Beginning in June 2020, the poor economy seemed overlooked in the eyes of buyers; pending home sales hit all-time highs. To view this chart, look at the monthly changes year over year. From June 2020 until March 2022, pending home sales were the strongest ever recorded. But starting in March 2022, a slowdown began, and numbers didn’t reach 2021 levels. We saw this trend continue until mortgage rates fell, from 8.9% back down to 6.5%.

Where Do Housing Prices Go From Here?

Since the Summer of 2022, the Federal Reserve has raised interest rates. Rates on 30-year mortgages are now over 6%. This has now started a decline in prices. The Federal Reserve is also still buying massive amounts of loans(1+ trillion a year) by printing money, to finance federal debts. This acts as a counterbalance to raising rates. Through the spring of 2023, it looks like housing prices are likely to trend down as the housing prices adjust to the higher interest rates. Prospective buyers face difficulties with affordability. Prices are still close to all-time highs, and higher interest rates add additional monthly costs.

The last four administrations decided to keep interest rates artificially low. The logic of this policy is up for debate, but the crux of the matter is the lower the interest rates, the higher the housing prices. In my opinion, this was the main reason for the sharp price inflation worldwide in housing since 2011.

With the Biden administration, this policy of market manipulation has continued providing price support. However, the jump in prices of most other goods and services has forced the Federal Reserve to raise rates. With this background, the cost of owning a house has increased even as the cost of the house can decrease. Simply put, though the actual cost of a house comes down, a purchaser’s monthly mortgage payment, insurance, taxes, and maintenance can all go up.

Why do interest rates affect housing prices so much?

It’s easy to see how interest rates affect Las Vegas prices, especially when considering investors.

When comparing over 5% returns on investment properties versus less than 1% in banks or taking the risk in the stock market, investors snap up properties and cause higher prices. If rents do not increase alongside housing prices, the market finds a new equilibrium. But during an inflationary period, like the one we are currently in, rents also go up leading to new rent over return on investment ratios. As long as rent prices increase, housing prices continue in an upward trend. When interest rates go up the reverse happens as investors find good returns in the debt market and the cost of mortgages pushes affordability down.

However, the Las Vegas housing market is not only a good buy because of the worldwide inflation in real estate and the mercy of interest rates. The State of Nevada has constant population growth outpacing the rest of the country. This growth is fueled by California migration, low taxes, and strong job growth. So assuming stability in inflation and interest rates, the Las Vegas housing market would likely have a nice slow growth in prices.

Modern Monetary Theory

It’s become very apparent that the monetary policy of the United States is now Modern Monetary Theory (MMT). Simply put, MMT is a theory in which printing money and the amount of money in the economy don’t correlate with higher prices. As The Federal Reserve Chairman likes to say, the reserve acts to control prices with their “tools in the toolbox”. These tools are draining the money supply out of the economy through taxes, manipulation of prices through the futures and derivatives markets, and the direct purchasing and selling of bonds by the Fed itself. This policy allows the Federal government to run huge budget deficits without raising taxes. For more information about this shift, a good starting place is Wikipedia.

My personal belief is this policy won’t work in the long term. The inflation we have today shows the weakness of this policy. We are no longer on a gold standard. That was lost in the 1960s during the spending increases for the war on poverty and the Vietnam War. What came after the gold standard was the fiat currencies of today. The US dollar is the world’s (current) predominant reserve currency, helped and supported by the Petro Dollar. The last twenty years have seen a vast over-printing of dollars, too many of which now reside outside the United States. As a consequence, a new basket of IMF (International Monetary Fund) currency is taking the dollar’s place. I believe this switch will cause even more inflation as the markets adjust to more fiat currency (government-issued currency unbacked by a commodity) being distributed in developing countries.

Here’s more information on the IMF Special Drawing Rights SDRs.

Monertist Theory

Over time, fiat currency is unfortunately overprinted. I believe fiat currencies can work long-term if governments have restraints on printing. This is known as Monertist Theory. From the 1970s until the early 2000s, central banks used this theory. Today, most governments of the world ignore Monertist Theory and instead believe the ‘spend and print’ principles of Modern Monetary Theory are correct. Here’s a video on the subject by Dr. Milton Friedman.

Sell, Buy, or Wait?

Different steps forward exist depending on how you’re looking to involve yourself in the market. The question is: What kind of buyer or seller are you?

My advice is:

- Investors, prices aren’t cheap in Las Vegas. The government allowing interest rates to move up close to the inflation rate is probably a good warning sign of a top. And remember, as mentioned earlier, keep an eye on pending home sales.

- If you’re looking for a property to make your home, compare the cost of renting a similar property versus the monthly costs of owning it. Also, remember that a portion of your mortgage payment goes toward the principal interest.

- Sell a part of your real estate investment, if you’re an investor that bought from 2010 to 2016. It’s probably a good time to take profits.

Sellers, prices are still close to all-time highs. Currently, The Federal Reserve is allowing interest rates to rise, and the forbearance period has ended. Now may be the best time to sell!

If interested in listing your property or for a home evaluation, please visit our selling your home page!

After the demise of Bretton Woods in 1971, the FED’s ability to create unlimited fiat money out of thin air is the root cause of all our problems and without the mindless interference by the FED (which does not know the relation between monetary inflation and price inflation), all the bubbles (including real estate) would have burst a long time ago before they assumed their current monstrous proportions.

However, since sanity is only a temporary disruption of the accepted behavior of today’s financial markets manifested by the Madcap Monetary Theory, I feel that any sign of a return to a free market-driven normalcy will only re-ignite the FED’s attempt to keep the hyperinflation going until we disappear into a black hole . . .

Unfortunately, there is a chance you are correct.